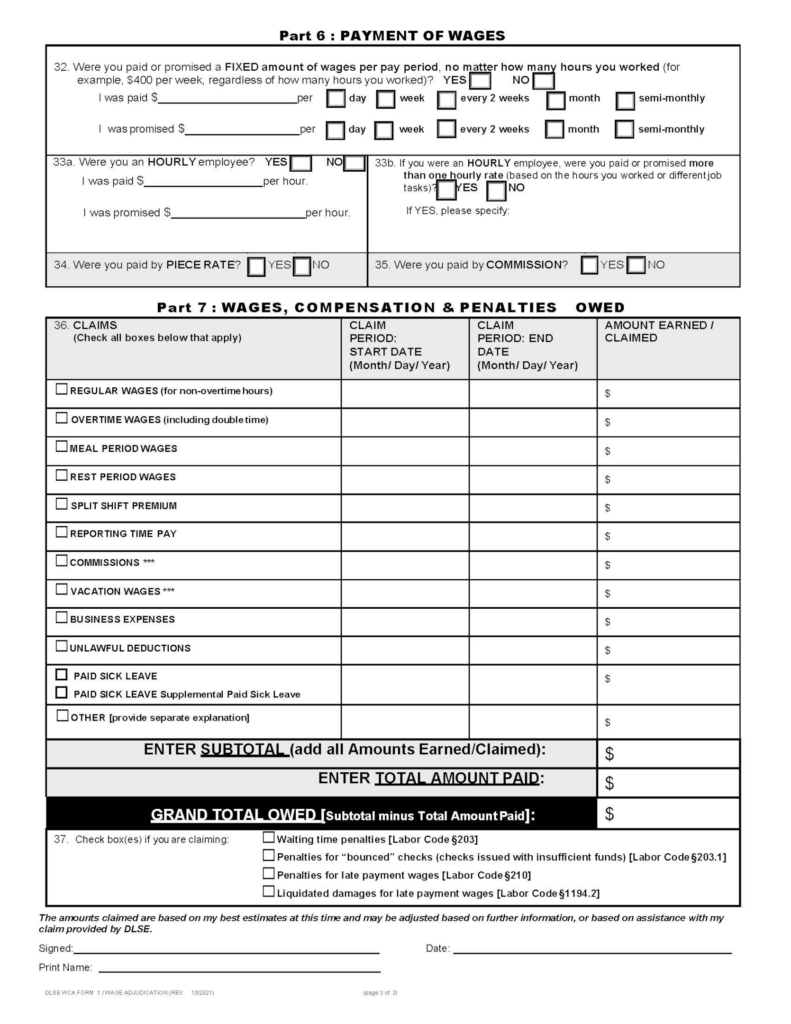

In California, "wages" are defined as compensation for labor or services performed by an employee, whether the amount is determined on a time, task, piece, commission, or other basis. Wages can include salary, hourly pay, non-discretionary bonuses, commissions, vacation pay, and other forms of compensation.

California employers are required to pay their employees for all hours worked at the agreed-upon rate of pay, including overtime pay for any hours worked in excess of eight hours per day or 40 hours per week. Employers must also provide employees with meal periods and rest breaks, and to pay employees for any unused vacation.

If an employer fails to pay wages or provide required benefits, employees may file a claim with the California Labor Commissioner , or pursue a lawsuit in court to recover the unpaid wages, penalties, and other damages.

Workers in California have the right to file a wage claim when their employers fail to pay them the wages or benefits they are owed. A wage claim starts the process to collect on those unpaid wages or benefits. Wage claims can be filed online, by email, mail or in person. California’s labor laws protect all workers, regardless of immigration status.

When a wage claim is filed, the Labor Commissioner investigates the claim to determine if the employee is owed unpaid wages or benefits. In most cases, a settlement conference between the employee and employer is scheduled to resolve the issues. If the issues are not resolved at the settlement conference, a hearing is scheduled so a hearing officer can review the evidence and make a decision on the claim.

Among other things, employers violate wage and hour laws by:

Failing to pay overtime is one of the most common wage violations by employers. In California, employees are entitled to time-and-half if they work more than eight hours in a day or 40 hours in a week; they are also entitled to time-and-a-half for the first eight hours on their seventh consecutive workday. Employees are entitled to double time for any hours worked beyond 12 in a workday and for any hours worked beyond the first eight on their seventh consecutive workday.

Not all employees are entitled to earn overtime. While hourly, nonexempt employees have a right to overtime, other categories of employees are exempt. The most common exemptions are for outside salespeople and "white-collar" employees who do professional, managerial, and high-level administrative work paid on a salary basis. Unless your employer can prove that you fit into one of these narrow exemptions, non exempt employees are entitled to overtime.

If your employer has failed to pay you for overtime hours, you are owed the difference between what you should have been paid and what you were paid. Time-and-a-half pay means that you're entitled to 50% of your hourly rate, on top of your regular pay. For example, if you are usually paid $16 an hour, you should be paid $24 an hour. And, double time pay means you are entitled to twice your regular rate of pay.

Employees are entitled to the highest applicable minimum wage where they work, whether that's the federal, state, or local rate. California's minimum wage is significantly higher than the federal minimum wage of $7.25. Some cities, such as San Francisco, have even higher minimum wage rates.

To calculate your unpaid minimum wage claim, simply take the difference between you were actually paid per hour and what you should have been paid per hour, then multiply that amount by the total number of hours you worked. For example, if your employer paid you $12 per hour instead of $15 per hour for your first two weeks of full-time work, you would be entitled to an additional $3 per hour for each of your 80 hours of work, or $240 ($3 × 80).

In certain states, employers may pay employees a wage lower than minimum wage if the employee receives enough in tips to make up the difference (called a "tip credit"). However, California does not allow a tip credit. If you receive tips as part of your compensation, you are still entitled to the full minimum wage for each hour you work and tips are extra beyond your hourly rate.

To file a wage and hour claim, you must file within one year for penalties regarding a bounced check or failing to provide access to, or a copy of, payroll or personnel records; within two years for an oral promise to pay more than minimum wage; within three years for violations of minimum wage, unpaid overtime, unpaid rest and meal breaks, sick leave, illegal deductions from pay or unpaid reimbursements; and within four years for a written contract.

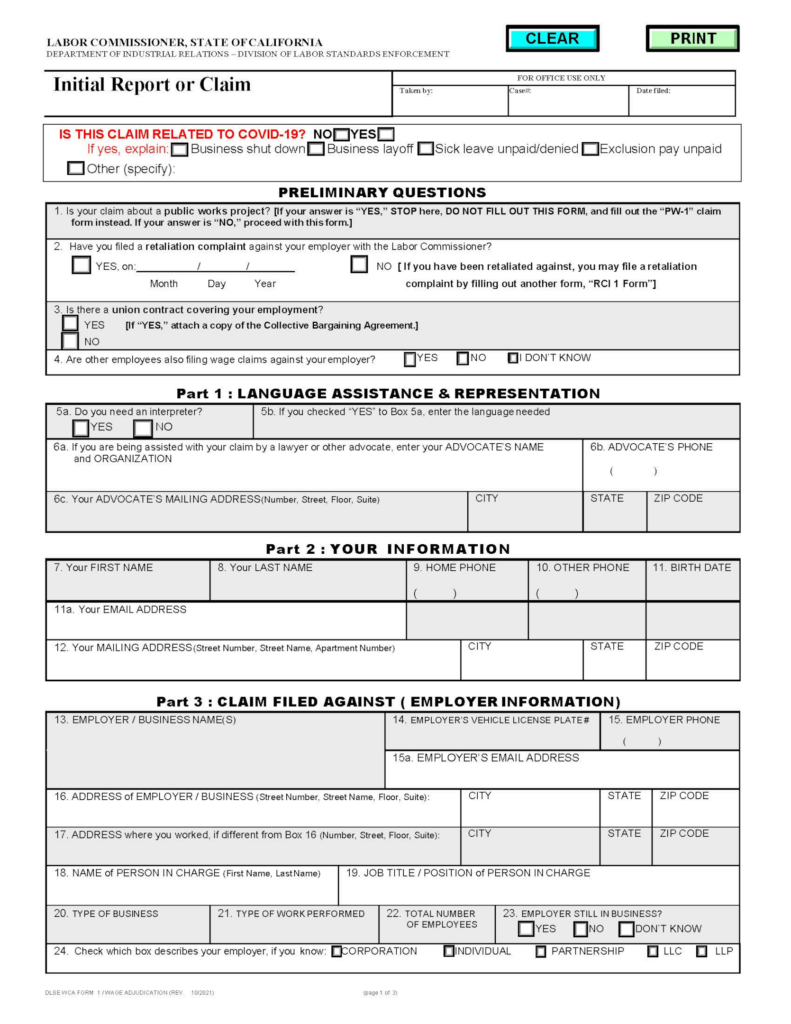

Employees need to file certain supporting documents to support their wage claim. These might include a computation of the employee’s unpaid wages, a computation of penalties that are owed, or evidence.

The Labor Commissioner’s Office will need the address and name of the company or individual that you work for in order to help you with your claim. The name of the company should be listed on paystubs, mailing labels, product labels, or if you cannot locate that information, you could write down their vehicle license plate number for the person who pays you. If you have more than one employer or supervisor, you might need to write down each of their names and vehicle license plate numbers.

Any person acting as a supervisor or manager who violates workers’ labor rights can sometimes be held responsible for civil action, in addition to the employer.

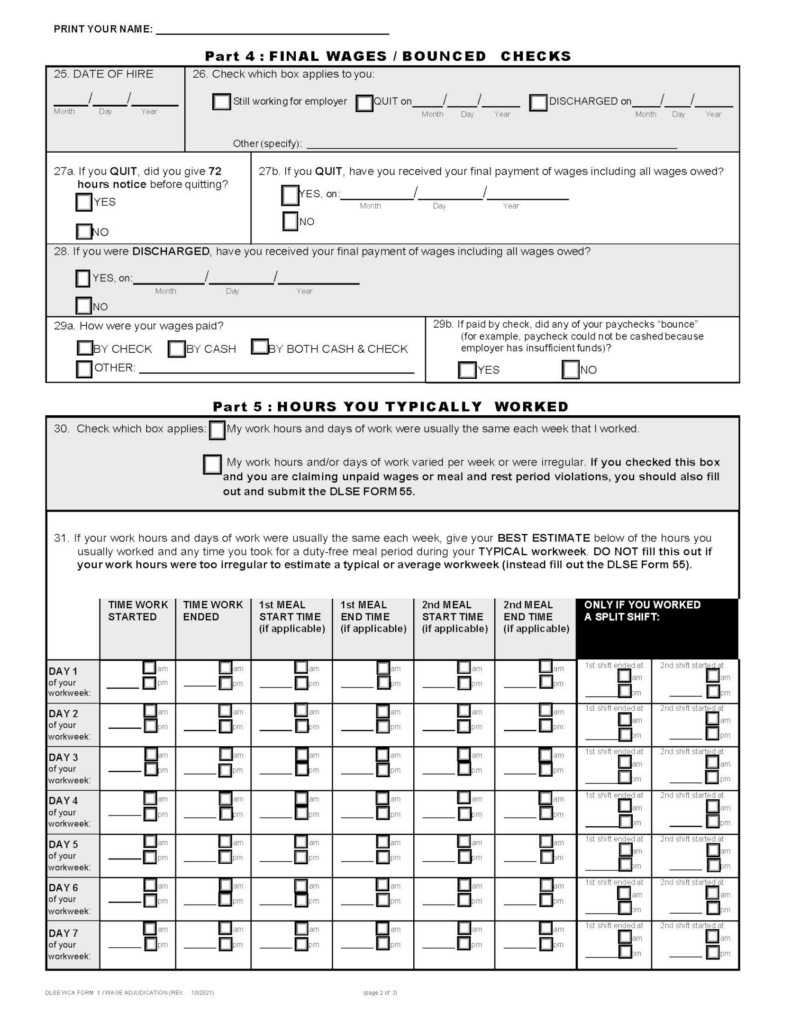

Write down the time you begin and end work every day, when you take meal and rest breaks or heat recovery breaks, and the total hours you work.

If you are paid by contract or piece rate, you should still earn at least the minimum wage for each hour worked. Keep track of the amount of time you spend on each contract or piece so that you can compare your total wages with the work you completed, to ensure you were paid for the work you did and that your pay before deductions equals at least the hourly minimum wage.

Each time you are paid, your employer must provide you with a paystub (piece rate pay stub) or detailed wage statement. This itemized wage statement must contain the following information: your name, wages earned, dates of the pay period, your employer’s name, address and telephone number, as well as all deductions (taxes, etc.) and hours of paid sick leave accrued.

All of the information and documents listed above will help you determine if you are paid properly, and will help support your case when filing a wage claim.

Please note: By law, your employer is required to keep accurate records of actual time worked. Your employer is also responsible for giving you an itemized wage statement each time you are paid. However, it is a good idea to keep track of your time and pay. The Labor Commissioner requests these documents if you have them available, because they could help the Labor Commissioner’s Office better understand your claim.

Once you have gathered the information about your employer and documents if you have them available, the next step in the process is to file a claim. You can file a wage claim with a local office of the Division of Labor Standards Enforcement. This can be done by filling out an Initial Report or Claim Form (see below). You can file your claim by email, mail or in person, download a claim form, complete and print it, attach applicable documents and mail to the Labor Commissioner’s Office.

DLSE Form 1 cannot be used to request an adjudication of claims relating to fraud or unfair business practices. Those claims are beyond the jurisdiction of the Labor Commissioner. They would need to be raised in a lawsuit filed in court.

It is important for the employee to identify all unpaid wage claims made against the employer that the employee might have. The failure to state all unpaid wage claims might prevent the employee from raising claims later that could have been resolved in the same administrative proceeding.

If the DLSE decides that a hearing may be appropriate, it will often, but not always, hold a settlement conference before a hearing is scheduled. This settlement conference is sometimes referred to as a conciliation conference.

The settlement conference is an informal meeting between the employer, the employee, and a Deputy Labor Commissioner. The conference is not a trial or a contested hearing. Parties are not put under oath and are not expected to present witnesses.

Instead, the employer and employee each explain their side of the dispute to the deputy and will generally discuss the evidence they will rely upon to prove their claim or defense if the case proceeds to a hearing. They may be asked to identify witnesses so that the deputy can estimate the amount of time that will be needed for a hearing.

The deputy will ask the parties whether they can resolve their differences and might make suggestions for settling the case. If, however, it is clear that the claim has no merit at all, the deputy may dismiss it without a hearing.

We often see clients who have viable court cases against their employers for:

We also see employees whose employers are violating California minimum wage laws.

The damages you can expect to receive in a successful wage and hour dispute depend on the type of law your employer has violated.

If your employer has failed to pay the minimum wage or you have unpaid overtime, you are able to collect the unpaid amounts–plus interest and reasonable attorney’s fees/litigation costs.

In addition, if you were paid less than the minimum wage, and this was not due to your employer’s good faith error, you may be able to win an additional “liquidated damages” award equal to the amount of the unpaid required wages plus interest.

If the wage/hour lawsuits are about an employer’s failure to provide the required meal or rest period, then you may receive one hour’s pay at the regular rate for each break that you did not receive.

Note that you may also be able to sue your employer’s officers, directors, owners, or managing agents if they caused your wage and hour rights to be violated.

If you have experienced wage theft you can file an online wage claim with the Labor Commissioner's Office. If you are not comfortable filing a claim on your own behalf, or you have a large or complicated wage claim, talk to an experienced California wage and hour lawyer about representing you.

A lawyer can file a wage claim on your behalf with the Labor Commissioner's Office or file a lawsuit in court seeking to collect your unpaid wages, plus offer the privileges of an attorney client relationship. If you win your lawsuit, your attorney can ask the judge to make your employer pay your attorneys' fees.

Ideally, you will want an attorney advertising a free consultation to assess the reasonable grounds of your wage and hour lawsuit or claim. At the law firm of Freeburg & Granieri, we provide just that.

Navigating California's complex wage and hour laws can be overwhelming, especially when dealing with unpaid wages, missed breaks, or overtime violations. At Freeburg & Granieri, APC, we are committed to ensuring that your rights are protected. Our experienced team in Pasadena specializes in wage and hour claims, helping workers recover the compensation they deserve. Whether you’re facing wage theft, misclassification, or unpaid overtime, or other employment legal problems, we are here to advocate for you every step of the way.

Don’t let wage violations go unchecked—take action today! Contact Freeburg & Granieri, APC, for a free consultation, and let us help you secure the compensation you're entitled to. Your fight for fair wages starts with us—book an appointment now and empower your case with our expert legal support in Pasadena.

Our clients become friends, confidants, and repeat customers. Former clients are our best referral source.

Do not be a commodity, find an attorney who treats your legal issue with the care it deserves.