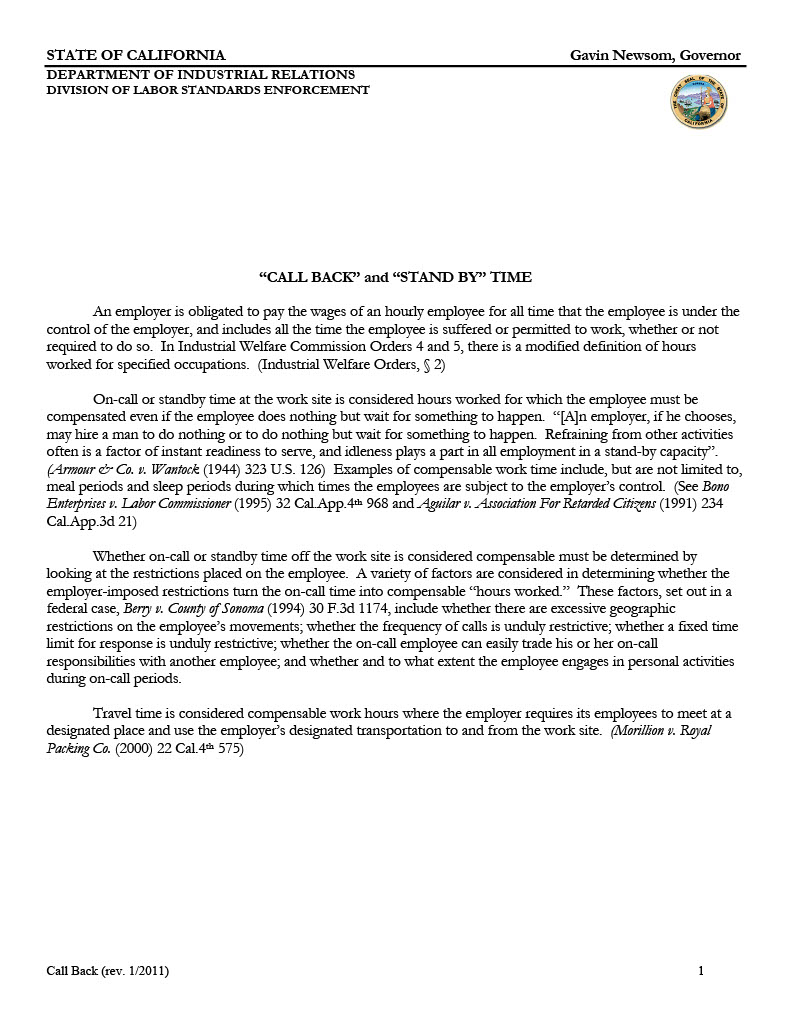

In California, non-exempt employees may be entitled to “on-call” or “standby” pay for hours spent not working, but still under their employer’s control. State labor laws give you a right to compensation of at least minimum wage for such “hours worked.” However, the specific rules for on-call hours in California can depend on certain circumstances of the on-call employee arrangement, hours worked, the employee’s job duties and regular working hours, and state or federal minimum wage and/or labor laws.

Under California law, an employee who is required to be “on-call” and available to work during their off-duty time is generally considered to be working and as such, they are entitled to proper compensation under California employment law. This fact stands even if the employee is not actually performing actual work during the on-call time.

On-call time is the time when you are subject to your employer's control but not working. While you may not be performing any of your job duties, you cannot do what you want to do. It is often called “standby” time.

Some examples of on-call time include

In all of these examples, the worker is not working but has to be ready to work in an uncontrolled standby. This keeps them from committing much of their time to something that they want to do.

California law used to allow the employer and employee to agree to exclude up to 8 hours for designated "sleep time" as long as the employee gets at least 6 hours of uninterrupted sleep.

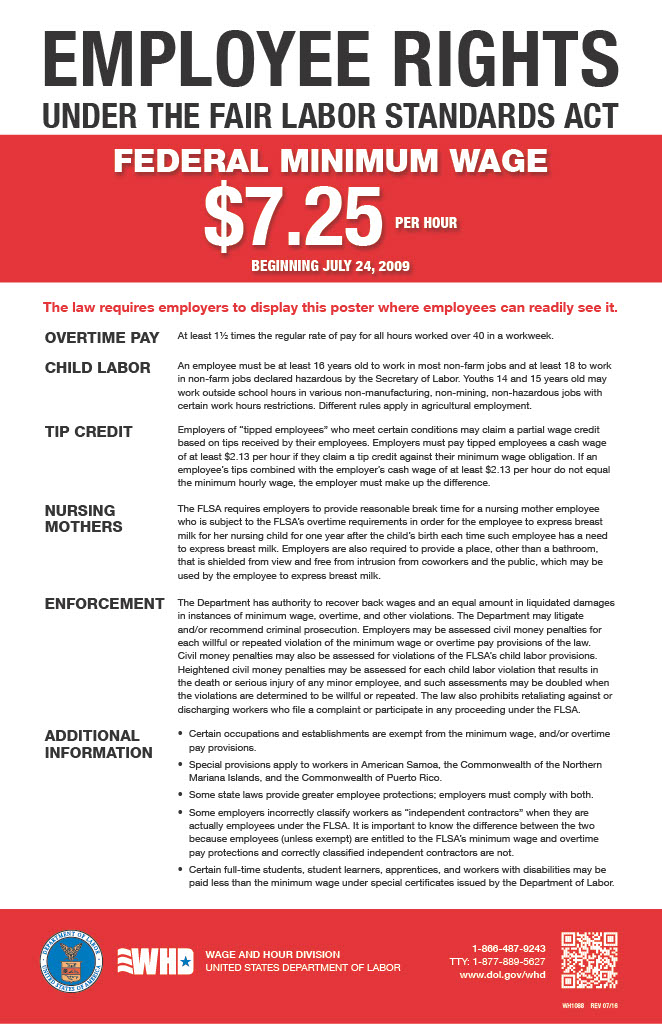

In other words, even if an agreement is reached, sleep time on an employer's premises cannot be excluded from hours worked. The California Supreme Court also stated that the Fair Labor Standards Act, which allows employers to exclude up to 8 hours of sleep time from the workday, did not preempt California law.

According to the California Supreme Court, there are 8 factors that can be used to determine whether your employer is exerting sufficient control over you for the time to be considered working hours:

None of these factors is dispositive. Additionally, the determination is often factually intensive. However, the more control your employer exerts, the more likely the time is compensable. If the control of the employer restricts the employee’s movements enough, it is a compensable time. The on-call employee’s right to a wage is subject to legal protections.

Under California labor law, if an employee is required to remain on the employer’s premises (a.k.a. under the employer’s control) or within a limited geographical area during the on-call time, the California employer is typically required to pay the employee for all time spent on-call, even if the employee is not actually performing work.

The rules for on-call pay can be more complicated if the employee is not required to remain on the employer’s premises during the on-call time and is free to engage in personal activities.

In general, an employee who is free to engage in personal activities during on-call time must still be compensated for the time spent on-call if the restrictions on their activities are significant enough to effectively limit their personal pursuits.

California regulations use slightly different rules for healthcare workers. Rather than defining “hours worked” under state law, they use the federal Fair Labor Standards Act (FLSA). Under the FLSA, you are generally less likely to be entitled to on-call pay.

According to the FLSA, on-call time is compensable largely based on 2 factors: the employment contract, and the degree to which you are free to engage in personal activities.

Regulations promulgated by the U.S. Department of Labor (DOL) state that being required to remain on your employer’s premises or very close to qualify for on-call shifts.

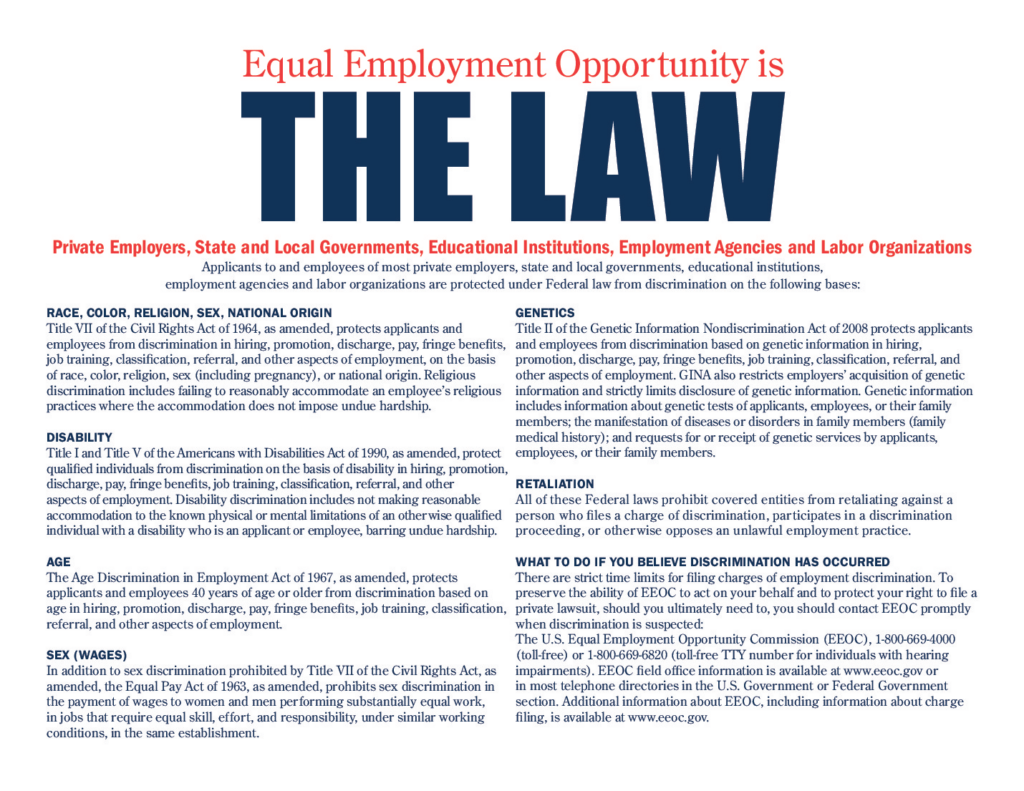

If you think that you are entitled to on-call pay but your California employer is not paying it, you can: file a complaint with the state labor agency, or file a wage and hour lawsuit against your employer for violations of California wage and hour laws.

You can file a wage complaint with the Labor Commissioner’s Office at the California Division of Labor Standards Enforcement (DLSE) at the Department of Industrial Relations (DIR). This can trigger an investigation by the agency. It will also initiate an alternative dispute resolution process.

You can also file a lawsuit against your employer for unpaid wages, including on-call and overtime pay. Many of these cases become class actions. If your employer is not reporting time pay correctly for you, other workers are likely affected as well.

At Freeburg & Granieri, APC, we prioritize the rights and fair treatment of our clients in navigating California's complex labor laws. If your employer fails to count work hours or compensate employees for the employee's time on a work site, contact Freeburg & Granieri, APC, an employment law firm, for a free consultation.

You can file a complaint with the state labor agency or initiate a wage and hour lawsuit. Our team can provide guidance and representation to ensure your rights are protected.

Understanding your rights regarding on-call pay and standby time compensation in California is crucial for ensuring fair treatment in the workplace. Whether you're entitled to compensation depends on various factors, including the control exerted by your employer and the nature of your job responsibilities. If you believe your rights have been violated, take action by contacting the appropriate authorities or seeking legal counsel.

Our clients become friends, confidants, and repeat customers. Former clients are our best referral source.

Do not be a commodity, find an attorney who treats your legal issue with the care it deserves.