Employee compensation is one of a company’s biggest expenses, which is why when faced with financial hardship, employers must sometimes make the difficult choice to either furlough or lay off workers. Furloughs and layoffs are two ways employers address the problem of not having enough work or enough budget for their employees' labor costs. Both options cut costs, but the similarities between furloughed or laid-off employees largely end there.

Below are general descriptions of furlough vs layoff - however, it is important to point out that not everyone will use these terms to mean the same thing. Understanding the context of the specific circumstances is more important than the terms furloughs and layoffs.

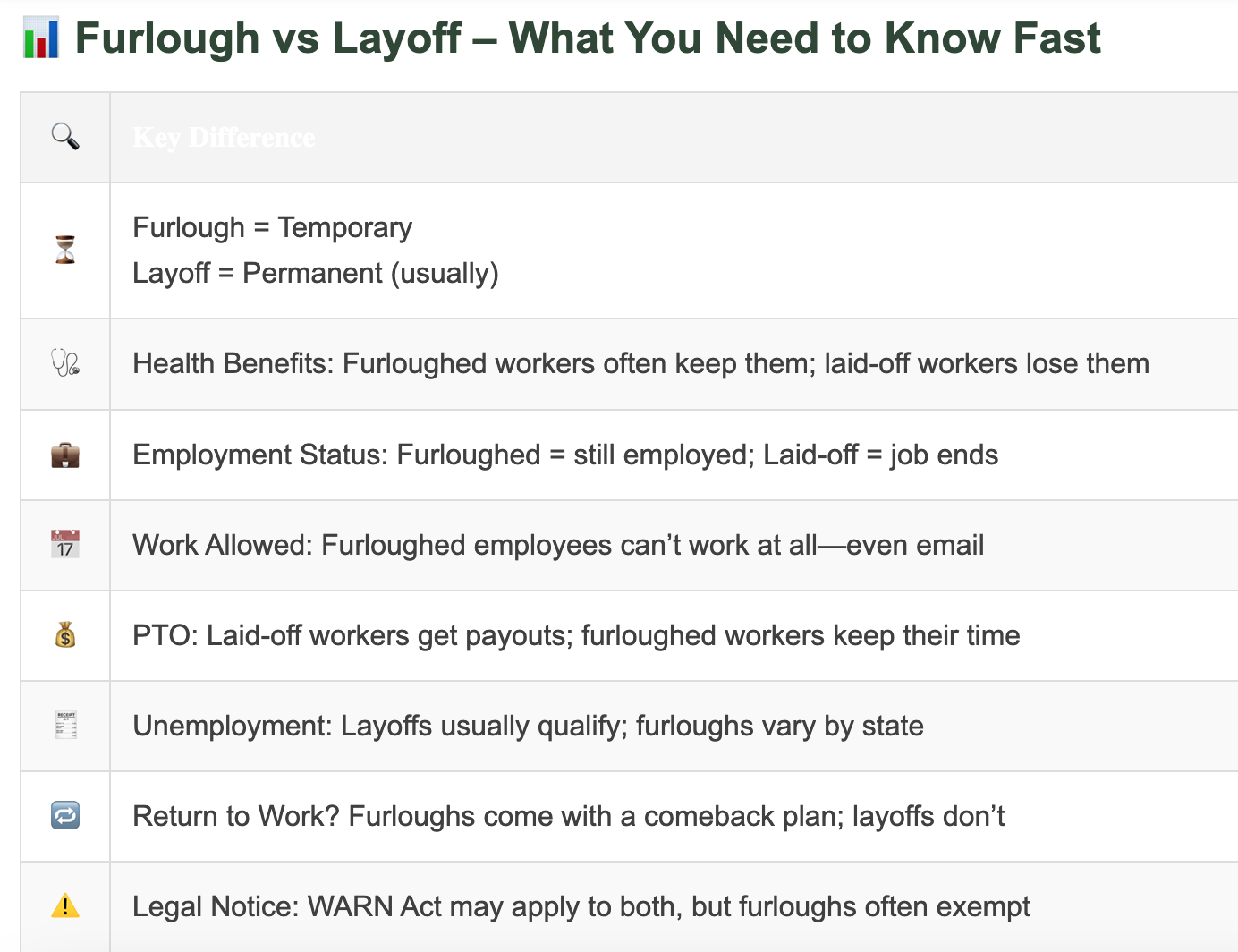

A furlough is a mandatory temporary unpaid leave of absence from which the employee is expected to return to work or to be restored from a reduced work schedule. Furloughs are often used when the employer does not have enough cash for payroll (for example, a government shutdown due to lack of budget approval) or when there is not enough work for all employees during a certain period and, by reducing employee schedules, the employer can avoid terminating employees.

Employers must be careful when furloughing exempt employees so that they continue to pay them on a salary basis and do not jeopardize their exempt status. A furlough that encompasses a full workweek is one way to accomplish this, since California law states that exempt employees do not have to be paid for any week in which they perform no work.

A furlough reduces hours, days, or weeks employees may work and usually has a finite length. A company can furlough employees for specified amounts of time and set the conditions of the furlough. They can require employees to use accumulated paid time off during the furlough, but generally (for cost-saving measures) they notify employees the furlough will consist of unpaid time.

There are key differences in the way employers can set the term for furloughs for hourly (nonexempt) workers versus salaried (exempt) counterparts. California law provides clearly written guidance on when exempt versus nonexempt staff members must receive pay.

For hourly employees, the furlough could include reductions such as:

Because these employees receive pay only for the hours they work, the terms of the furlough can impact any or all the hours they would normally be on the payroll.

For salaried employees, furloughs will need to be in blocks of at least 1 week each. Salaried employees, because of their exempt status, need to earn their full salary for any week in which they work. California furlough law specifically requires exempt employees receive pay for any week in which they perform work — regardless of the number of hours they’ve put in during that week. The only way to furlough exempt employees is to do so for entire weeks at a time.

A furlough can be structured in different ways and have different causes. Here are a few scenarios:

Furloughed workers cannot perform job duties in any capacity during the furlough period. These zero-tolerance rules include everything from simply checking email to performing any type of work on behalf of their employer. Even a 5-minute phone call will violate the terms of the furlough. For salaried employees, this could require full pay for a week; for hourly employees, it could require pay for the time worked.

An exempt employee must be paid their full salary for any week in which they perform work, regardless of the actual hours. This means that they can only be furloughed in weekly increments at minimum, during which time they are forbidden from engaging in any of their usual job responsibilities. Their access to work-related programs may even be restricted or their employer-issued devices confiscated to ensure compliance.

Unlike a salaried employee, an hourly employee who is furloughed may continue to work in some circumstances. Their employer may simply reduce their total hours per day or their total days per week. A company also has the option of furloughing employees for weeks or months at a time – a situation commonly referred to as zero-hour schedules.

The good news about being furloughed is you may not need to look for a new job. Employers often implement furloughs to spread a reduction in work across employees because they want to keep those employees.

The bad news is that you may still have enough work—or a strong enough promise of future work—that you can't easily make up for the pay you're losing and don't want to invest a lot of time in a job search. However, the extra time could also allow you to explore a job change or pursue additional education or training that you were already interested in but didn't have time for.

When it comes to a furlough vs layoff, a layoff is generally considered a separation from employment due to a lack of work available. The term "layoff" is mostly a description of a type of termination in which the employee holds no blame. An employer may have reason to believe or hope it will be able to recall workers back to work from a layoff (such as a restaurant during the pandemic), and, for that reason, may call the layoff "temporary," although it may end up being a permanent situation.

A layoff is a qualifying event under the Consolidated Omnibus Budget Reconciliation Act (COBRA), but a furlough is not. Workers who are furloughed generally continue to receive healthcare benefits through their employer, except for when their hours are reduced so much that they no longer meet the provider’s eligibility requirements. When this happens, furloughed employees, much like those who are laid off, may qualify for COBRA and receive extended coverage under the employer’s group health plan.

Employees who are laid off generally receive payouts for any accrued time in their PTO balance in their final paycheck. Furloughed employees, on the other hand, keep their outstanding vacation time, personal and sick days. They may even be able to use PTO to receive payment while they are not working.

Generally, displaced employees are legally required to actively look for work in order to qualify for unemployment benefits. But most furloughed employees, because they still have a job, don’t fulfill this requirement. Regardless of that fact, some states will extend benefits to them (such as allowing them to collect unemployment benefits), while others will not. Laid-off employees, conversely, usually qualify for unemployment insurance as long as they’ve earned the minimum amount of income in the past year to be eligible.

The bad news about being laid off is that you'll almost certainly need to look for other jobs. These can be temporary jobs until you find a new job or more permanent employment. You will also want to immediately look into applying for tax benefits and public assistance you may be eligible for, such as health insurance subsidies.

If you've been with the same employer for long enough, you may receive severance pay or a severance package. This can reduce the financial blow of being laid off and give you more time in your job search, but severance may reduce or make you ineligible for unemployment benefits. But a company is not required to offer a severance package.

Furloughed employees usually resume their job when the furlough ends, while workers who are laid off have no assurance that their employer will ever rehire them. Even seasonal workforces that experience temporary layoffs are not guaranteed placement from season to season.

Both layoffs and furloughs may require advanced notice on behalf of the employer, depending on the jurisdiction. Businesses that meet the criteria outlined in the Worker Adjustment and Retraining Notification (WARN) Act must notify employees within 60 days of any mass layoffs or plant closings. These federal requirements generally do not apply to most company furloughs, although some have mini-WARN state law of their own with strict guidelines.

Although there is often no clear answer as to whether an employer should furlough or lay off employees, a company may be restricted in their choices. For example:

For small businesses that employ union employees under a collective bargaining agreement (CBA), the release of employees for any reason – furlough, layoff or straightforward dismissal – is governed by several rules in the CBA.

Employees of a major corporation – one that either cannot lose market share or is part of the national security apparatus – are much more likely to be furloughed, such as when a rotating employee schedule might open up more work while also easing financial burdens.

Assuming your business has the freedom to choose between furloughs and layoffs, you’ll need to evaluate several factors to determine what works best for your organization and current situation. Employers must weigh the costs of each choice against what is best for their employees (both those being laid off and those who stay behind) as well as the impact of either choice on their reputation.

A small business may choose furloughs over layoffs because it allows them to retain valued team members. When their situation improves, they can bring their employees back and avoid spending more money and time on recruiting and developing new employees.

Choosing furlough vs layoff of employees should be a decision based on the best information a company has at the time, there are pros and cons to both furloughs and layoffs. On one hand, furloughed employees may continue to have health benefits and a chance to return to their job at a later date. On the other hand, employees who are laid off get a head start on finding a new job, which may be better than a protracted furlough that results in a layoff anyway.

It’s essential to plan for the present and potential needs of your company and consider your employees’ best interests. Understanding the potential impact of furloughs and layoffs will help clarify which option is better in your case.

At Freeburg & Granieri, APC, we understand that navigating employment challenges like furloughs and layoffs can be daunting. Whether you’re an employer trying to make tough decisions or an employee facing uncertain times, our experienced team in Pasadena is here to guide you every step of the way. With our deep understanding of employment law, we’ll help you protect your rights and make informed decisions.

Ready to take control of your employment situation? Contact us today to schedule a consultation and explore your options with the experts at Freeburg & Granieri, APC.

Empower your future with the right legal employment support. Book a consultation, and let us help you confidently navigate these critical decisions.

Our clients become friends, confidants, and repeat customers. Former clients are our best referral source.

Do not be a commodity, find an attorney who treats your legal issue with the care it deserves.