Unpaid overtime is money an employee earned by working more than 40 hours in a week for which their employers fail to pay. An employer who requires or permits an employee to work overtime is generally required to pay the employee premium pay for such overtime work.

In this guide on unpaid wages and overtime pay, we will be discussing the specifics of unpaid overtime laws, as well as any compensatory and liquidated damages in the event of employer wage or overtime violations.

In the United States, federal law defines a standard workweek as 40 hours. If you have worked more than that time in a single week, any additional hours require overtime payment. In most instances, the overtime pay rate is one-and-a-half times. This means that one overtime hour is worth 150% of your regular hourly pay rate. Employers are not permitted to average your working overtime weekly hours across multiple weeks. Consider the following example:

Suppose that you worked 30 hours one week and then worked 50 hours the following week. In a case like this, your employer would be required to pay time-and-a-half on ten hours the second week.

Even though you would have worked an average of 40 hours each week, your employer owes you overtime pay and cannot avoid paying overtime by averaging these hours over the pay period. As of 2020, anyone earning less than $684 per week, or an annual salary of $35,568, qualifies for overtime. Employees earning more may also still qualify if they do not fall into an exemption category.

Federal law sets the minimum for what overtime pay has to be. States can set their own laws that give employees even more protection than given under Federal law. It is important to know what wage and hour law(s) apply to your employment.

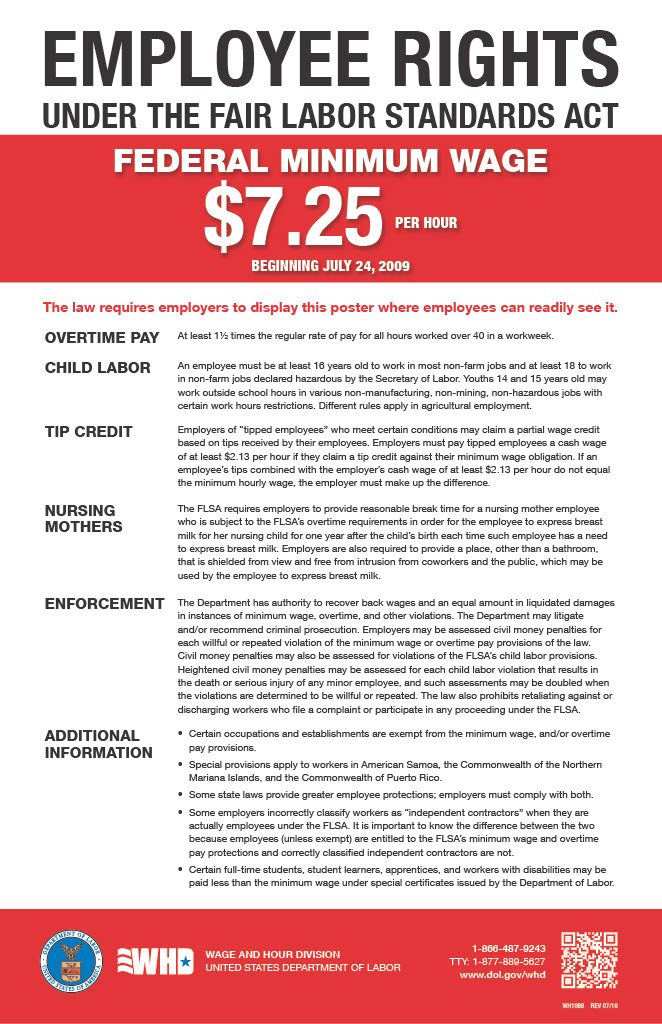

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

Unless specifically exempted, employees covered by the Act are owed overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one-half their regular rates of pay. Furthermore, the regular rate of pay cannot be less than the minimum wage. Your employer is legally required to pay overtime rates for these hours worked in accordance with labor laws and your job title. If you have worked overtime hours to fulfill your job duties and have not received financial compensation, you could have grounds to file an unpaid overtime claim against your employer under the FLSA.

The FLSA is a federal law passed by Congress in 1938, designed to protect worker’s rights by ensuring they are properly compensated for their efforts. This bill is responsible for many of the rights US employees enjoy today such as the 40-hour work week, time and a half overtime (over 40 hours a week), and the abolishment of child labor.

The FLSA requires that workers be divided into “Exempt” and “Non-Exempt” categories, which determine whether they are eligible to receive overtime. Exempt employees are generally salaried workers. While Non-exempt employees are usually workers who are paid an hourly wage for each hour worked. The law states that no worker shall be required to work more than 40 hours per week, without due compensation.

The Equal Pay Act (EPA) of 1963 is a United States labor law amending the Fair Labor Standards Act, which prohibits sex-based wage discrimination between men and women in the same establishment who are performing under similar working conditions.

Every year thousands of Americans are forced to work unpaid or underpaid overtime due to fear of losing their employment. If you or a loved one have worked overtime, which is more than 40 hours per week for hourly employees, and have not been paid overtime, you may have an unpaid overtime case as an FLSA claim. Some other examples of FLSA violations include:

Unpaid time and a half after 40 hour work week

Negotiated wages under time and a half standard

“Off the clock” work, required by employer

Unpaid mandatory training days

Classifying “non-exempt” employees as “exempt” employees

No pay for time spent changing in and out of uniforms, otherwise known as “donning and doffing”

Classifying work as “volunteer work”

Requiring hourly employees to take work home with them

Failure to pay employees for miscellaneous work related tasks

Failure to pay federally mandated minimum wage

Failure to pay overtime

“Processing errors” that leave out time to be paid

These are just examples of the many ways that employers can potentially violate the FLSA. Other instances may arise. If your employer has paid you less than minimum wage, or you have failed to receive overtime pay, required additional labor, or lied about pay, you may have an FLSA claim or unpaid overtime lawsuit.

Businesses and employers are legally required to pay workers a regular rate for all non-overtime work hours. When employees work more than the standard rate, they must be paid a premium overtime wage.

Unfortunately, some businesses and corporations do not operate in their employees’ best interests. If you are owed unpaid overtime from your employer for hours worked, you may be able to file a legal claim to recover the money that you are due.

In many cases, workers can pursue unpaid wages and interest on the withheld amount. In some instances, the law requires businesses to pay additional penalties for unpaid overtime wages.

Many U.S. citizens face financial difficulties due to insufficient wages. Some minimum wage positions lack proper sick leave, paid time off, parental leave, and health insurance.

These financial challenges are exacerbated when an employer withholds the money that employees have rightfully earned. Employees who work over the standard number of hours per week are legally owed premium overtime compensation.

When tightfisted companies withhold overtime payments, they are in violation of wage-and-hour laws. Withholding appropriate pay is a wrongful action known as “wage theft.”

Wage theft happens when a business wrongfully takes earnings from its workers. Even if this type of theft happens in small increments, the costs for workers can add up.

Employees who have not received the money they are due for the work completed can choose to file an unpaid wage claim and sue their employers in an unpaid overtime lawsuit to receive overtime compensation.

The first attempt to recover your unpaid wages should be made internally by discussing the problem with management or addressing it with the payroll department. In case that doesn’t help, you should meet for a free consultation with an employment lawyer about whether to pursue a private cause of action or file a state agency claim. It is important to consult with an attorney to know which one of the strategies makes sense (based on your situation). Suppose your employer’s wage policies affect other employees. In that case, an attorney might suggest bringing all the claims together (class action) and using the same attorney to vindicate your rights.

Such claims are handled by your state's department of labor or the governmental agency responsible for protecting employee wages. First, you will file a form based on your particular circumstances. You will be required to provide your personal information, along with information about your work history and employer. To substantiate the claim, employees usually must submit some type of evidence that may include a notice of communication, dishonored checks, time records, and check stubs. According to employment laws, employers cannot discriminate against or fire an employee who files a claim against them for enforcement of the FLSA. Employees usually have up to 2 years from the date of the violation to file an unpaid wage claim under overtime laws - but this statute of limitations will depend on your applicable state law.

For example, when the New York state agency investigates your case and concludes that your employer has intentionally violated the FLSA, he or she may be prosecuted and fined up to $10,000 (with a subsequent conviction that can result in their imprisonment). The payment of the wages owed may be supervised by the Wage-Hour Division, which may also pursue a court injunction to prevent the employer from taking specific action and can require employers to liquidate damages.

If investigations reveal that your employer failed to pay you appropriate overtime wages for any qualifying overtime hours you worked (e.g. withheld wages), you may be entitled to back pay as well as additional compensation from your employer. If your employer refuses to provide back wages or if state or federal agencies fail to resolve your claim, you have the right to file an unpaid overtime lawsuit against your employer in civil court. The majority of unpaid wage claims filed through a state agency get settled outside court.

If you decide not to pursue your claim through a state agency, you can hire an employment lawyer to pursue a private cause of action. Attorneys who practice wage and hour law are knowledgeable and experienced professionals who deal with unpaid wage cases, and they are able to provide advice on whether it’s worth pursuing a case. If there are advantages to suing for unpaid wages (such as a faster resolution or higher rewards), your attorney will advise you on the best move to make.

When employers retaliate against workers who claim they were not paid, wage dispute retaliation claims may arise. The FLSA provides employees with statutory causes of action for employer retaliation and termination that may arise out of wage and hour disputes with the employers.

Most employees are protected by state wage laws, federal wage laws, or both. If you think that your employer has committed wage and hour violations (e.g., failing to pay you minimum wage or overtime pay), you can recover your unpaid wages by filing a lawsuit. However, the amount of time you have to file is limited, and that time limit is called the statute of limitations.

Most states have their own wage and hour laws with their own statute of limitations. In New York, the statute of limitations for filing a wage lawsuit is 6 years (3 years more than federal law provides). In California, the statue of limitations is 3 years. Employment attorneys can help you file unpaid wage lawsuits or claims before any applicable deadline, to ensure that both your state and federal law claims are preserved.

Under the FLSA, employees must file a lawsuit or claim within 2 years of the date of the violation. In case your wage violation is ongoing, you will be allowed to recover unpaid wages only for the 2 years prior to filing your lawsuit or claim. If your employer willfully violated the FLSA, the statute of limitations is extended to 3 years.

Employees can file a wage claim before with the U.S. Department of Labor’s Wage and Hour Division before the statute of limitations expires. That way, there will still be enough time to sue your employer if you’re unable to resolve the claim through the Department of Labor. Employees can also file an unpaid wage claim with their state department of labor.

If you eventually decide to pursue legal action, you should know that filing in court is a more complicated process. If your claim is not straightforward and small, then you should consider hiring an attorney advertising free consultations and meeting with him or her before filing anything. A wage and unpaid overtime law firm will advise you during this free case evaluation and help you determine whether you have a case worth pursuing.

“Damages” is a term used to describe monetary compensation paid to the victims of wrongdoing. Unpaid overtime settlements usually involve the business paying damages to the worker.

The amount that you can secure through an unpaid overtime lawsuit will depend on the specific circumstances of your case. Damages in these cases usually fall into a few categories. These categories are unpaid wages, interest, penalties, and legal fees.

This type of damage is intended to compensate the victim for the wages that they earned but were denied. When an employee successfully pursues an unpaid overtime settlement, the court will likely rule that they must be given the money they are owed.

This amount will include overtime premiums that were previously withheld. When an employer has paid regular rates for overtime worked in the previous pay cycle, the victim will receive the difference between their standard pay and overtime rate.

Hiring a skilled employment attorney can help you to recover the wages that you are rightfully owed.

Employees who are victims of wage theft can also pursue interest on the unpaid wages that they are due. State laws determine the amount of interest that is applicable to unpaid wages.

This functions to discourage business owners from stealing from their workers. In lieu of interest, you may be able to secure “liquidated damages.” This amount is predetermined by federal wage law.

When an employer acts in bad faith and purposefully underpays workers, they may have to pay liquidated damages.

In some states, corporations that engage in wage theft are required to pay additional penalties. These penalties are owed in addition to previously unpaid wages.

For instance, California requires corporations that have stolen from their employees to pay damages for a “waiting time.” This penalty is equal to 30 days of the workers’ regular pay rate.

After filing a successful unpaid overtime suit, the employer is also typically required to cover the claimant’s legal fees including attorneys' fees and litigation costs.

When your employer fails to issue wages or proper payment for tips or unpaid overtime, you have the right to file a lawsuit. However, you must do that in accordance with the statute of limitations. Freeburg & Granieri has an experienced team of skilled law attorneys that can help you pursue a case against your employer and fight for your rights. To see if you are still eligible to sue for unpaid wages, feel free to contact our law firm for a free legal consultation with an employment attorney today.

Our clients become friends, confidants, and repeat customers. Former clients are our best referral source.

Do not be a commodity, find an attorney who treats your legal issue with the care it deserves.