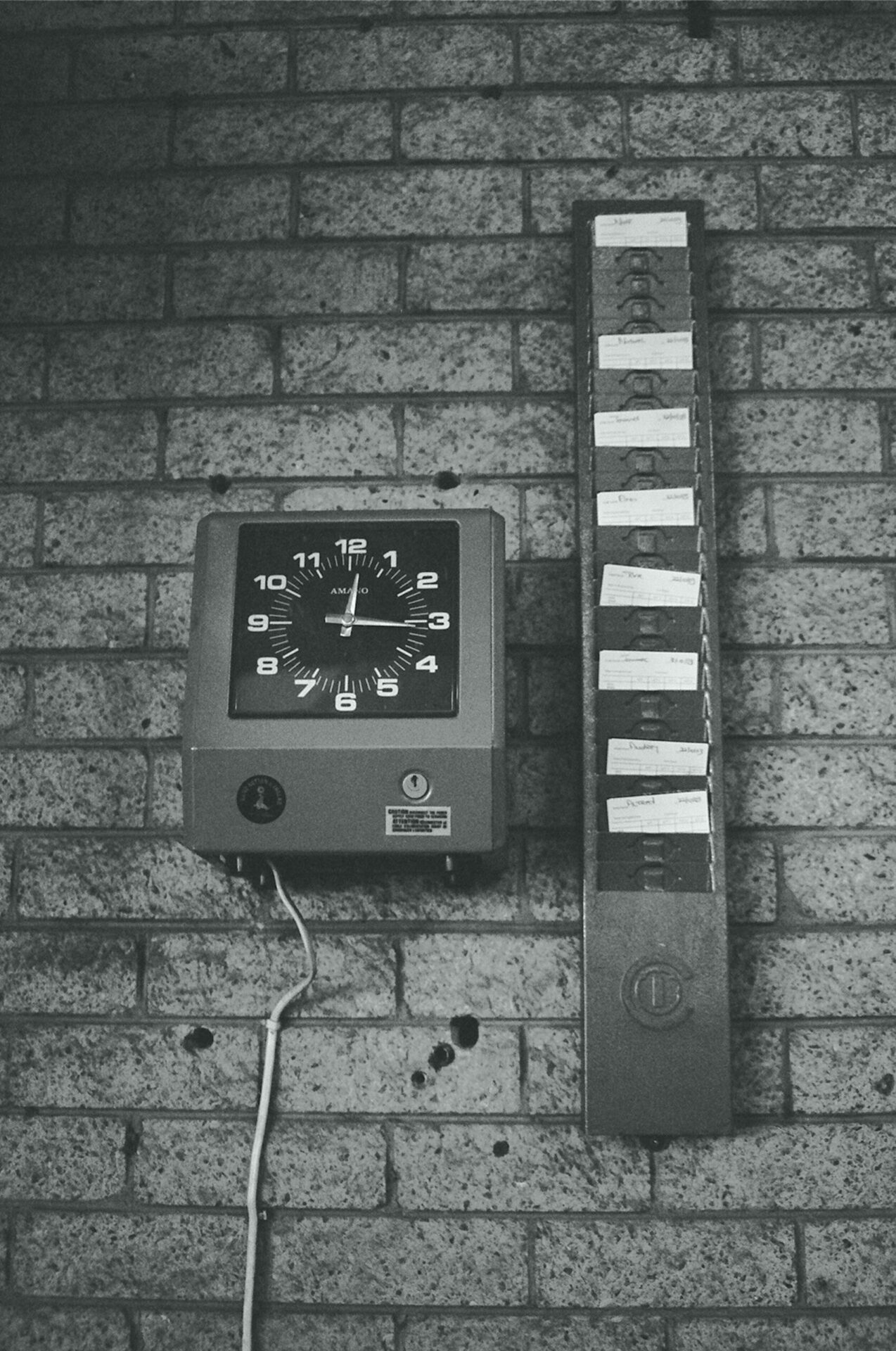

In Donohue v. AMN Servs., LLC, 11 Cal. 5th 58 (2021), the California Supreme Court held that a company cannot use timeclock rounding when evaluating whether an employee was provided a 30-minute meal period prior to the end of the fifth (5th) hour of work. An employer must look at unrounded time first to determine whether or not an employee took a timely and full 30-minute meal period. If not, then the employee is entitled to a meal period penalty, which is one (1) hour of pay at the employee’s regular rate of pay. The Court further held that rounding is still an ok practice for calculating hours worked if it favors the employee.

For employees, it is important that you are paid for all hours that you work and that your employee is not taking your wages. You should check your timeclock records and paystubs to make sure you are being properly paid. If you think you are not being paid all your wages, please contact the attorneys at Freeburg & Granieri, APC today.

For employers, now is the perfect time to review your timeclock and timekeeping practices. It is also the perfect time to review your meal periods and rest break policies. Please contact Freeburg & Granieri, APC today to have your policies reviewed.

Our clients become friends, confidants, and repeat customers. Former clients are our best referral source.

Do not be a commodity, find an attorney who treats your legal issue with the care it deserves.